income tax calculator philippines

Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. Counties cities and districts impose their own local taxes.

2022 Bir Train Withholding Tax Calculator Calculator

The calculator was created as an aid to compute your income tax.

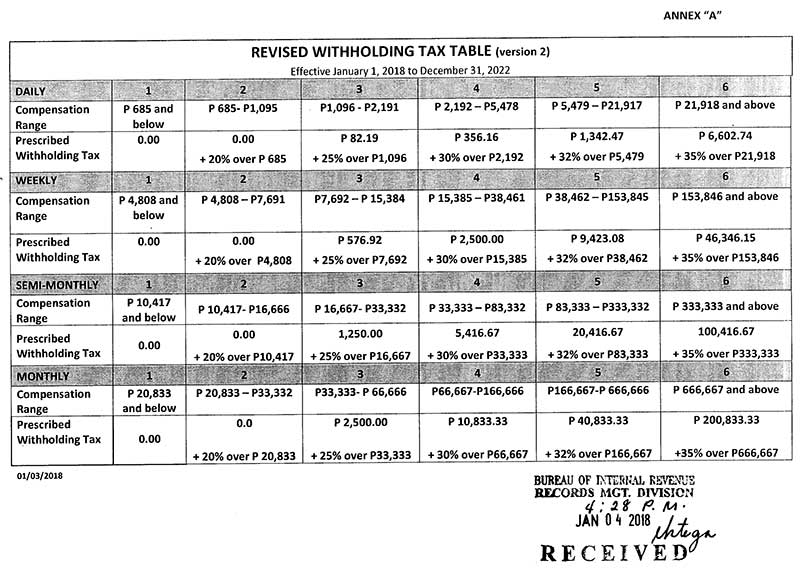

. Husband PHP Wife PHP Gross income. Calculate United States Sales Tax. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

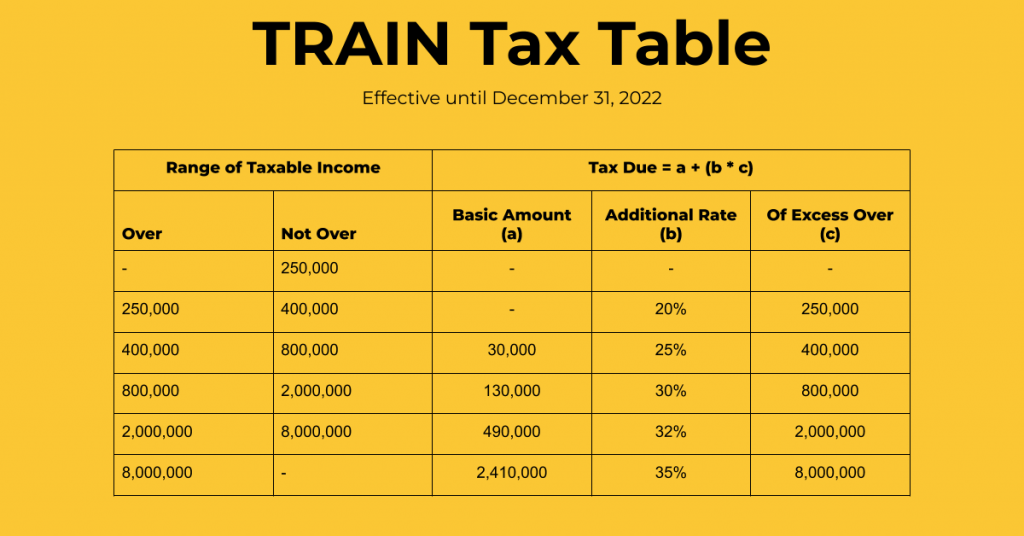

Income Tax is a tax on a persons income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as. 6 rows The Tax tables below include the tax rates thresholds and allowances included in the. This tax calculator aids you identify just how much withholding allowance or extra withholding has to be noted on your W4 Form.

You must always be sure to go with the best efficient updated and legitimate online tax calculator program. United States Sales Tax. It is the 1 online tax calculator in the Philippines.

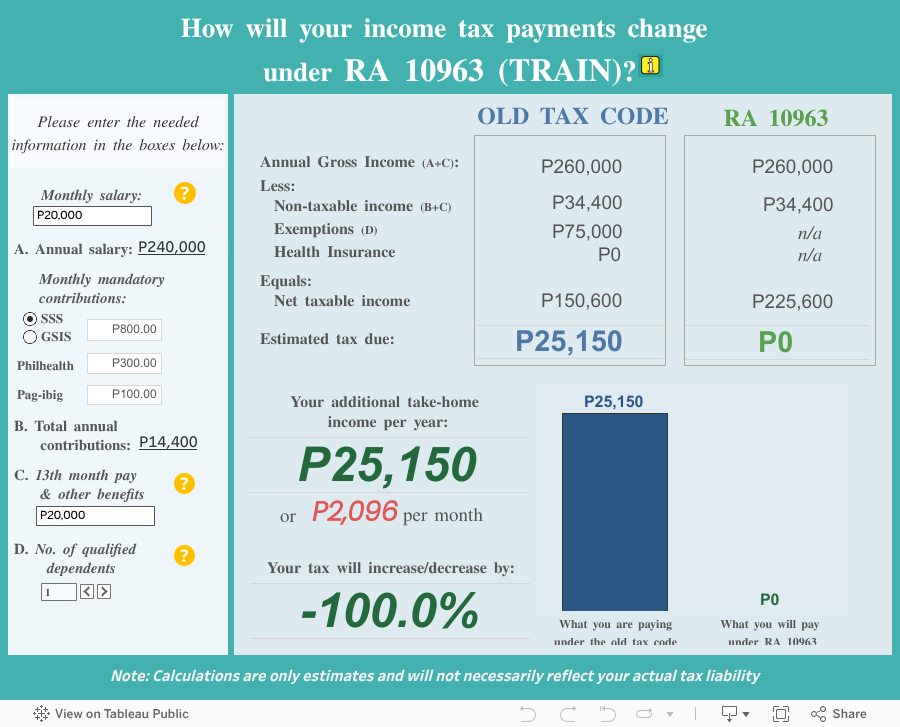

So if you are earning the minimum wage of Php 15000 you can have an additional take-home pay of Php 154183 per month under the 2018 tax reform. There is base sales tax by most of the states. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

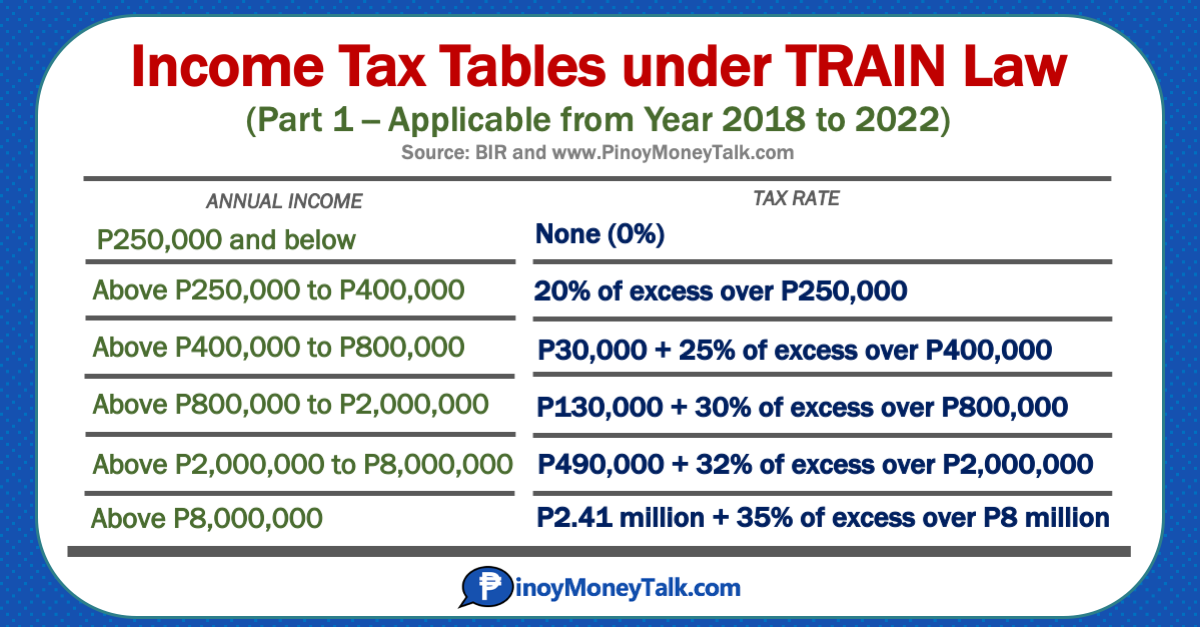

August 16 2021 by Klein Maijima. The calculator is designed to be used online with mobile desktop and tablet devices. Before the enactment of this new law an individual employee or self-employed taxpayer would normally have to file an income tax at the rates of 5 to 32 depending on ones bracket.

Tax withheld by employer per Form 2316 2 118000 0. Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends royalties and.

See California Texas Florida New York Pennsylvania etc. Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours. Review the full instructions for using the Philippines Salary After Tax Calculators which details.

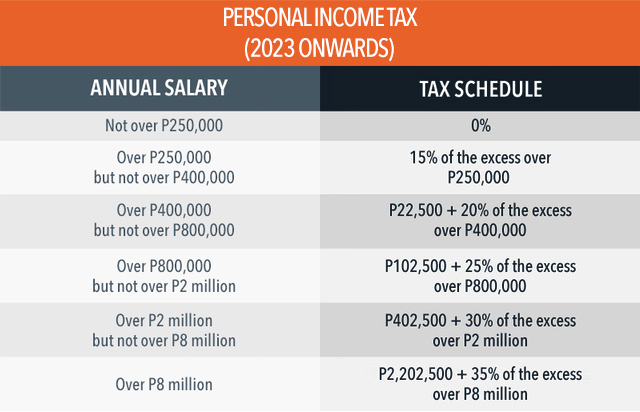

6 rows The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35. PH debt now 635 percent of GDP - Philippine Daily Inquirer. Review the full instructions for using the Philippines Salary After Tax Calculators which details.

This estimator can be employed by virtually all taxpayers. And is based on the tax brackets of 2021 and 2022. Since your taxable income is 2200245 the computation will be as follows.

Sales Tax in US varies by location. The calculator is designed to be used online with mobile desktop and tablet devices. This calculator was originally developed in Excel spreadsheet if you wish to get a copy please subscribe to our Youtube channel and.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Income Tax Taxable Income 12 X Y 12 Where X is the minimum value of the particular salary range and Y is the respective percentage. On first 250000.

This will calculate the semi-monthly withholding tax as well as the take home pay. There are now different online tax calculators in the Philippines. Philippine economy grows 83 in Q1 beating expectations - Philippine Star.

Car industry up 40 in April 2022 - Philippine News Agency. Taxumo is the best option for digital tax filing in the Philippines. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG.

Income Tax Calculator Philippines Who are required to file income tax returns Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under income tax category use this online calculator to calculate your taxable income. As debt-to-GDP ratio bloats to 635 economists tell new admin to raise taxes avoid populist projects - GMA News. Tax Incentives Management and Transparency Act TIMTA Process Task Force on Fees and Charges.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2020 and is a great calculator for working out your income tax and salary after tax based on a Annual income. An online tax calculator in the Philippines like Taxumo is a reliable resource. The Tax tables below include the tax rates thresholds and allowances included in the.

The Philippines Tax Calculator is a diverse tool and we may refer to it as the Philippines wage calculator salary calculator or Philippines salary after tax calculator it is however the same calculator there are simply so many features and uses of the tool Philippines income tax calculator there is another that we refer to the calculator functionally rather than by a. Income Tax 2200245 12 250000 020 12 2640294 250000 020 12 280588 12 Income Tax 23382. No validation process is being performed on the.

Highlights of the FIRB Accomplishment Report CY 2014. On remainder of 352000 at 25. Procedures for Availment of Tax Subsidy of GOCCs.

Tax Calculator Philippines Description of Calculator. Tax Return Income Calculator The tax withholding estimator 2021 allows you to compute the federal income tax withholding.

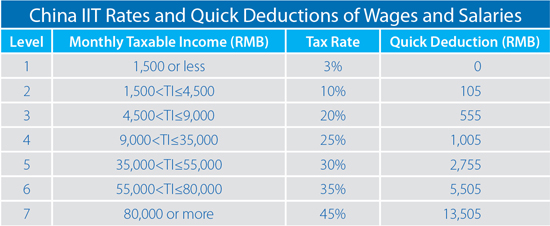

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Tax Calculator Compute Your New Income Tax

Tax Calculator Compute Your New Income Tax

How To Calculate Income Tax In Excel

Income Tax Calculation Formula With If Statement In Excel

2022 Bir Train Withholding Tax Calculator Tax Tables

Tax Calculator Compute Your New Income Tax

How To Create An Income Tax Calculator In Excel Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Foreigner S Income Tax In China China Admissions

How To Compute Your Income Tax Using Online Tax Calculator An Ultimate Guide Filipiknow

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

Table Take Home Pay Under 2018 Tax Reform Law

Tax Calculator Philippines 2022

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Provision For Income Tax Definition Formula Calculation Examples